Investment

Investmen Outlook

1. Economic Overview

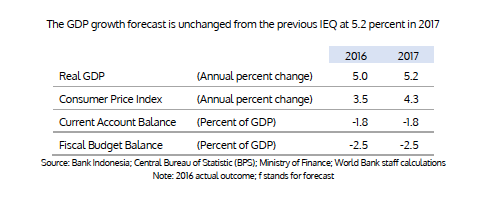

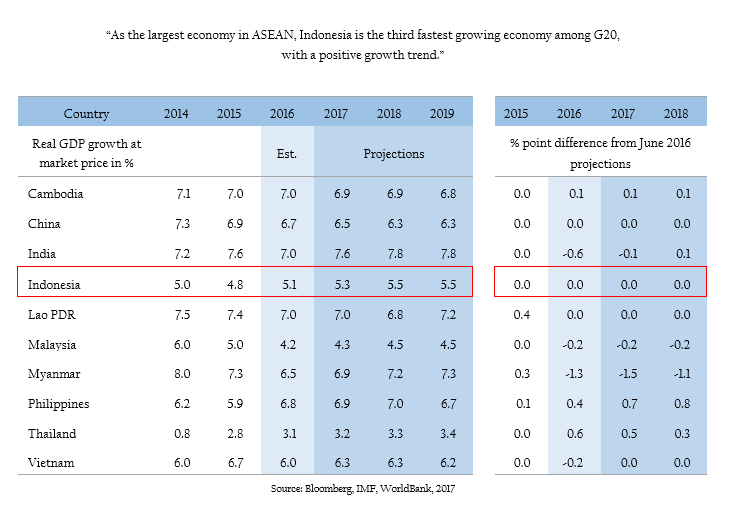

Economic outlook is positive with a supportive global economy and strong domestic fundamentals.

With a more conducive world economy, coupled with improved domestic fundamentals, the outlook for the Indonesian economy continues to be positive.

Despite global policy uncertainty and the risk of increased trade protectionism,

the world economy is becoming more supportive with faster economic growth,

a rebound in international trade, relatively accommodative financial conditions,

and a moderate recovery in commodity prices. Indonesia’s real GDP growth is

projected to increase from 5.0 percent in 2016 to 5.2 percent this year,

and further strengthen to 5.3 percent in 2018 (table below).

World Bank national accounts data, and OECD National Accounts data files.

In the baseline forecast, investment is expected to firm up due to the ongoing recovery in commodity prices,

improved investor confidence buttressed by the S&P rating upgrade, and lower commercial lending rates.

Exports growth is expected to surge this year and stay robust in 2018,

lifted by stronger external demand in line with faster global economic

growth and the rebound in global trade.

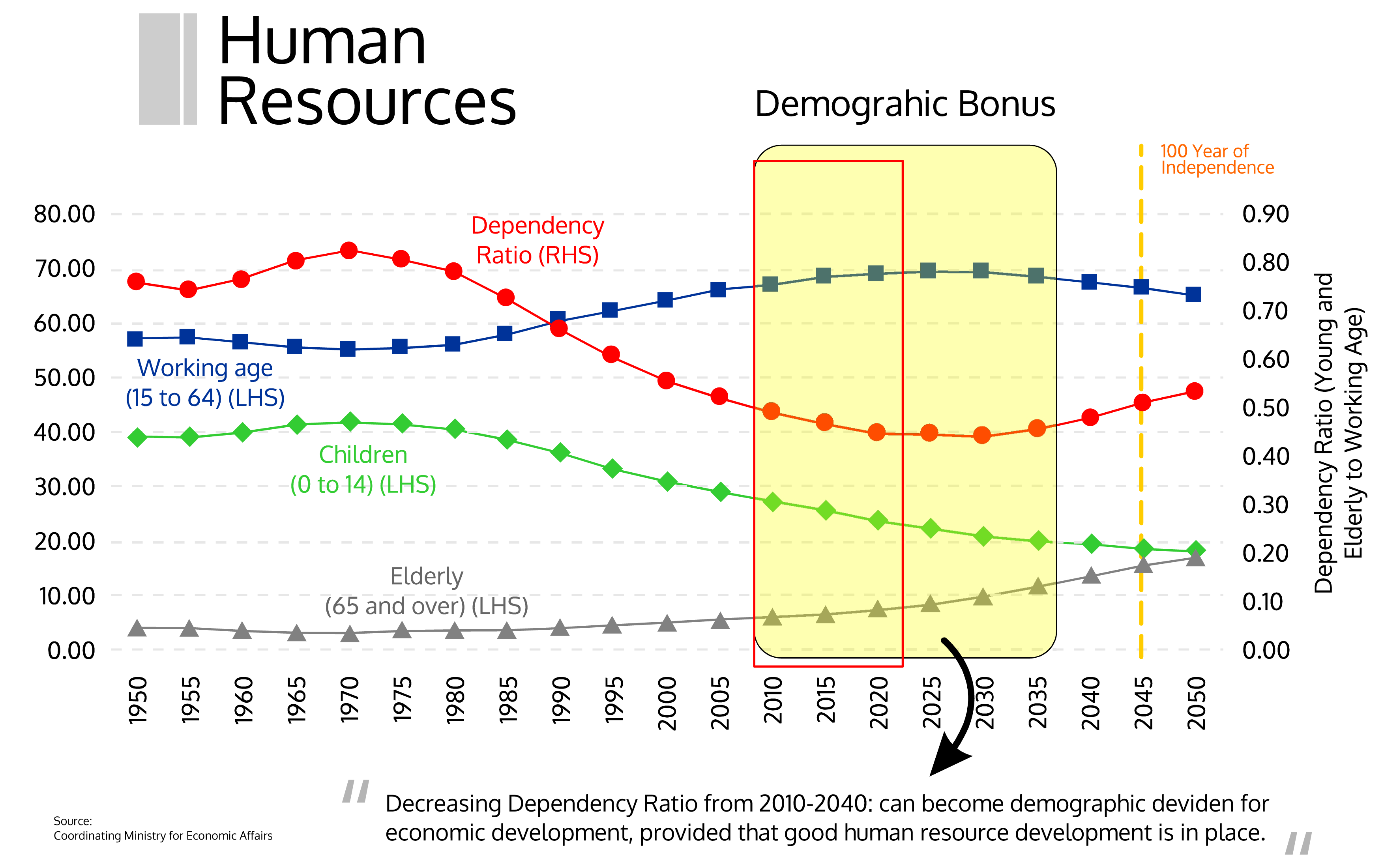

2. Demographic

Demographic bonus becomes a strategic opportunity for Indonesia to accelerate its economic development,

supported by the availability of productive age population in significant quantities.

The Statistics Indonesia (BPS) estimates that Indonesia will enjoy a

demographic bonus era in 2020-2035. During this period, the number of

productive age population is projected to be at highest chart history,

reaching 64 percent of the total number of Indonesian population of 297 million

people

3. Domestic Market

Indonesia, a country of 277 million people, is Southeast Asia’s largest economy with a GDP of 1.19 trillion USD in 2021. While the economy contracted in 2020, it rebounded in 2021, growing by 3.69%., driven by stronger global growth and a gradual improvement in domestic demand. By the end of 2021

The Indonesian economy possesses sound fundamentals of social stability, strong domestic demand for goods and services, steadily increasing foreign reserves (just under $139. billion in March 2022), and stable prices with moderate-to-low inflation, although non-core inflation has incrementally risen during the first half of 2022. However, persistent trade and investment barriers driven by protectionist sentiment, persistent and pervasive corruption, poor infrastructure, inconsistent interpretation and enforcement of laws, and labor rigidity continue to inhibit greater levels of economic growth and prosperity.

4. Natural Resources

Thanks to its geological location and large surface area, Indonesia is very rich in resources. It can produce a large variety of minerals at a very high level. To a large extend, the gas and oil reserves are increasingly used for Indonesia’s own economy.

Indonesia's oil and gas sector

Indonesia had a proven amount of oil reserves of approximately 2.5 billion barrels in 2019, while only producing approximately 0.3 billion billion barrels of crude oil in the year 2018. As an archipelago with over 17,000 islands, Indonesia faces difficulties in reaching and exploiting their oil reserves. The same applies to the natural gas reserves. Coal production on the other hand requires less complex and less expensive extraction methods, making it more economically valuable to Indonesia. Thanks to this and its geographic location close to emerging markets like India and China, Indonesia gradually increased their coal production in the past 20 years.

The mining sector is on the rise

Minerals are becoming increasingly important for a large variety of industries especially in the electronics sector. In 2014, the Indonesian government implemented a ban on exports of unprocessed minerals hoping to subsidize producing industries in Indonesia. The most important minerals found and produced in Indonesia are tin, bauxite, nickel, gold and copper.

SERVICE

Business SetupEPC Service

Sales Support

Market Analysis

Business Matchmaking

Product Regristration

INVESTMENT OUTLOOK

Business LocationBusiness Opportunity

Economic Growth

Political Stability

Domestic Market

Natural Resources

Demographic

Destination

MULTIVESTINDO

MULTIVESTINDO